Institutional Stablecoins and the Value Chain Shift

Across the market, there has been a lack of clarity around where value is accruing in the stablecoin ecosystem and where infrastructure is still emerging. This piece is not about predictions. It is a map. A way to contextualize past value capture, current momentum, and the structural layers that make up the ecosystem. We developed this framework to guide our internal thinking on product priorities and market engagement, and we are sharing it to help others better understand where platform needs are evolving and where infrastructure demand is likely to grow.

The Rise of Stablecoins as Settlement Infrastructure

Stablecoins are rapidly asserting themselves as the next great institutional settlement layer. Originally conceived as more efficient rails for the nascent digital asset exchange market, they’ve matured into programmable, yield-bearing infrastructure, quietly reshaping how value moves across chains, banks, and borders. As stablecoin volumes and regulatory clarity grow, we see a subtle but significant shift: value is migrating from endpoints (wallets, custodians, apps) to coordination layers that route, aggregate, and settle capital in real-time.

This shift is fueled by macro and structural tailwinds. Higher interest rates have made the stablecoin business significantly more profitable, creating powerful incentives for both incumbents and new entrants. The ability to generate yield on reserves has drawn new players into the field, most notably PayPal with PYUSD and Ripple with RUSD, signaling that competition is heating up and the opportunity is entering a new institutional phase.

The Stripe acquisition of Bridge only added urgency to the question VCs and infrastructure builders are now asking: where does value accrue next, and who owns the flow? With banks exploring stablecoin wallet integrations and institutions warming to tokenized money, the answer is shifting away from consumer rails and toward orchestration and liquidity systems that abstract settlement and scale access across jurisdictions.

Making Sense of the Stack

From the outside, the distinctions between these layers can seem frustratingly fuzzy. Categories blur. Platforms straddle multiple functions. Depending on your vantage point, the same company might appear as a liquidity provider, aggregator, or orchestrator. However, having operated in this space since 2018 across market cycles, regulatory shifts, and evolving client use cases, we’ve developed a clear framework for how the institutional stablecoin stack is forming. This post breaks it down layer by layer, function by function, with real-world examples placed where they operate, not just where they claim to.

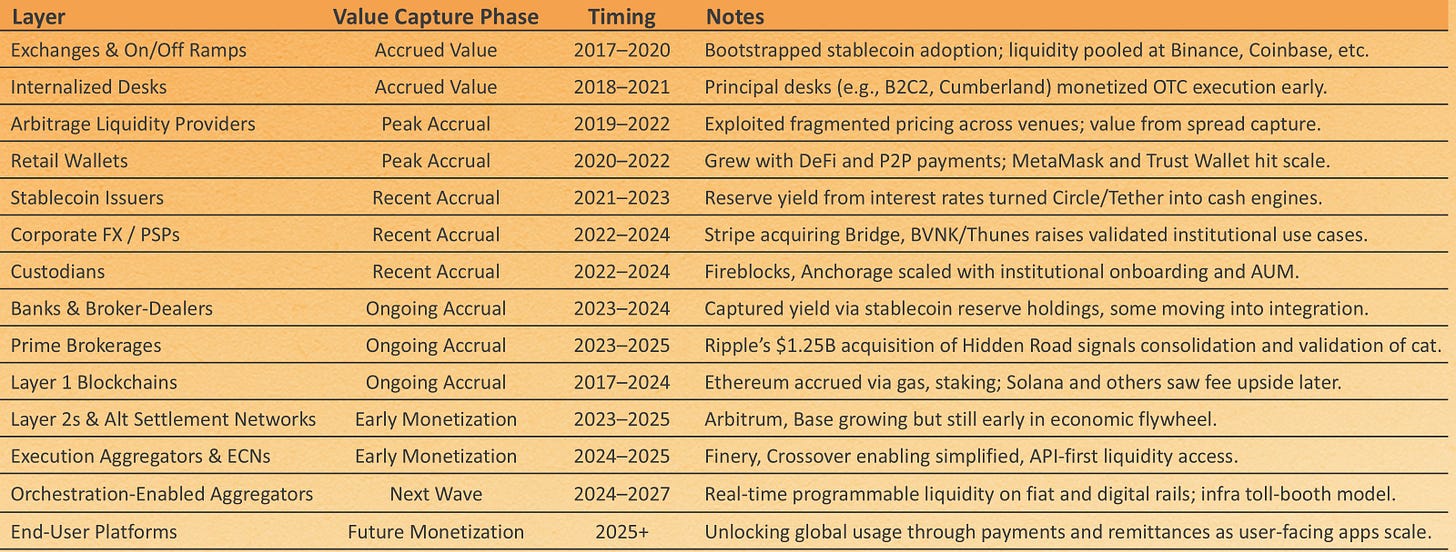

As the stablecoin and digital asset ecosystem has evolved, value has accrued at different layers of the stack at different times, starting with exchanges and principal desks, and more recently shifting toward infrastructure and institutional services. The table below maps where and when each category captured the most economic value, helping contextualize where the future opportunity lies. Importantly, these phases refer to past or current periods of value capture, not to the maturity or relevance of each category today. 1Konto operates in the Orchestration-Enabled Aggregators layer, which is emerging as the next high-leverage infrastructure tier, where programmable access to fiat, stablecoin, and custody rails enables real-time, capital-efficient operations for institutions.

The Layers of the Stablecoin Ecosystem

1. Supply Layer – Creation & Issuance

Entities responsible for minting, backing, and operating stablecoins.

Stablecoin Issuers

e.g. Circle (USDC), Tether (USDT), Ondo (USDY), PayPal (PYUSD), Ripple (RUSD)

Stablecoin issuers create, redeem, and manage the supply of digital currencies pegged to fiat or other assets. They partner with regulated banks and custodians to safeguard reserves, and many operate under regulatory frameworks that require disclosure and attestation of holdings. Leading issuers manage billions in daily volume and serve as systemic liquidity anchors across centralized and decentralized markets. Institutional users gravitate toward issuers with strong compliance postures, transparent reserve reporting, and seamless fiat on/off-ramp integrations. USDC and USDT dominate current adoption, while a new class of yield-bearing and programmatic stablecoins is beginning to gain institutional interest as treasury teams look to optimize idle balances.

Revenue Model: Interest on reserve assets (e.g. Treasuries), minting and redemption (create/burn) feesBlockchains (Layer 1 and Layer 2)

e.g. Ethereum (ETH), Solana (SOL), Tron (TRX), Avalanche (AVAX), Polygon (POL)

Blockchains process and record transactions involving stablecoins across various chains. Institutions generally favor Ethereum's security and robust tooling, while Tron dominates global USDT volume due to its speed and low transaction cost. These chains enable finality and transaction settlement, often abstracted by applications but critical to the flow of funds. Settlement networks earn revenue through network fees and allow users to hold the native asset of the Layer 1 (Ethereum, Tron, Solana) or Layer 2 (Polygon, Avalanche) chain. Users holding these tokens gain exposure to the underlying ecosystem's price action and economic growth.

Revenue Model: Staking rewards, appreciation of native tokens held by users, economic exposure to Layer 1 or Layer 2 ecosystemsBanks & Broker-Dealers

e.g. BNY Mellon, Britannia Bank & Trust, Black Rock, Cantor Fitzgerald

Banks and broker-dealers serve as the foundational fiat custodians for stablecoin issuers, managing the reserves that back digital assets like USDC and USDT. These institutions safeguard deposits, facilitate short-term investments of excess reserves, and provide essential infrastructure for global fiat settlement. They earn revenue through net interest margin on held balances and service fees for custody, fund movement, and reporting. Though often invisible to end users, banks are critical to maintaining reserve integrity, enabling rapid redemption, and delivering last-mile fiat access across jurisdictions.

Revenue Model: Net Interest Margin (NIM) on held balances, float income, basis points (bps) on Assets Under Custody (AUC), liquidity fees, service fees for custody, fund movement, reporting, and FX conversion

2. Infrastructure Layer – Access & Storage

Where institutions hold funds and access the rails directly.

Custodians

e.g. Anchorage, BitGo, Coinbase Custody, Copper

Custodians safeguard digital assets on behalf of institutional clients and their sub-clients. They offer secure storage, regulatory coverage, and increasingly provide services like staking, trading, and settlement. Qualified custodians are required for many fund structures. Custody is a base layer of trust in the stablecoin value chain, but competition is rising from embedded custody offerings.

Revenue Model: BPS on AUC, NIM on fiat balances, platform/account fees, transaction fees (digital assets & wires), trading & lending fees via internal liquidity poolsInstitutional Wallet Services

e.g. Fireblocks, GK8, Utila

Institutional wallet services offer programmable, policy-based digital asset storage and movement. They rely on MPC, user permissions, audit trails, and integrations with compliance tools. These services are tailored to firms with operational complexity and often integrate directly into settlement workflows, abstracting away blockchain interaction.

Revenue Model: Platform fees, Asset-based or volume-based fees, API-based SaaS pricing (wallets created, transactions performed)Retail Wallet Services

e.g. Coinbase Wallet, MetaMask, Phantom, Trust Wallet

Retail wallets are consumer-facing applications for self-custody and decentralized finance access. While not purpose-built for institutions, they’re often how end users receive or hold stablecoins. These wallets prioritize UX and chain interoperability over compliance or enterprise integration.

Revenue Model: Swap fees, in-app purchase fees (e.g. gas top-ups), referral fees from integrated on/off-ramps, and affiliate revenue from staking or bridging partners

3. Coordination Layer – Credit & Capital Efficiency

Entities that simplify multi-venue access, manage risk, and optimize flows.

Prime Brokerages

e.g. FalconX, Hidden Road, XBTO

Prime brokers offer unified access to multiple liquidity venues, credit intermediation, and post-trade services like margining and clearing. They simplify market access while absorbing counterparty risk. Prime brokers differ in their ability to provide execution, settlement, or both. They sit between infrastructure and execution layers, improving capital efficiency. They typically operate on a net-settlement basis with an end-of-day settlement structure. Ideal fits for Arbitrage Liquidity Providers and Internalized Desks to hedge risk intraday.

Revenue Model: Margin financing fees, trading spreads (if offering execution), clearing and settlement fees, API or platform access fees, and volume-based rebates or markups

4. Liquidity Layer – Price Discovery & Execution

Participants that quote, aggregate, or arbitrage pricing.

Exchanges with Stablecoin Ramps

e.g. Coinbase, Binance, Kraken, OKX

Exchanges offer on/off ramps for converting fiat into stablecoins and vice versa. They serve as key liquidity venues and often provide API access for automated trading and treasury operations. While exchanges also serve custodial and ramp functions, their primary role in the stablecoin value chain is facilitating price discovery and execution. They anchor liquidity, offer stablecoin/fiat trading pairs, and drive both institutional and retail price formation. Ramps vary widely by jurisdiction, asset pair availability, and regulatory compliance. Institutional onboarding can be slow, and spreads may be less competitive than OTC venues. Some exchanges also offer direct retail-facing applications that prioritize ease of use but often charge higher fees and spreads, making them less optimal for sophisticated activity but suitable for retail users seeking frictionless access to stablecoins alongside embedded wallets and payment tools.

Revenue Model: Trading fees (maker/taker), mint/burn fees on stablecoins, deposit/withdrawal fees, custody or account service fees for institutional users, premium fees on retail-facing platforms and mobile appsArbitrage Liquidity Providers

e.g. Flow Traders, GSR, QCP, Wintermute

An arbitrage liquidity provider identifies and exploits pricing inefficiencies across exchanges, OTC venues, and liquidity pools by executing offsetting trades to capture spread. These firms rely on low-latency infrastructure, automated cross-venue routing, and proprietary strategies to remain market-neutral. They typically do not intermediate client flow or assume balance sheet risk beyond the short-term arbitrage window. Arbitrage LPs operate passively yet critically in the background, tightening spreads, balancing fragmented order books, and contributing to efficient price discovery across the market.

Revenue Model: Arbitrage spread capture, proprietary trading profits, rebates from venues, and inventory optimization across fragmented marketsInternalized Desks

e.g. B2C2, Cumberland, Galaxy Digital

Internalized desks act as principal counterparties, quoting two-way markets while managing inventory. They aim to internalize client flow and selectively assume risk, dynamically hedging exposure. These firms monetize through bid-ask spreads and can provide deep liquidity, especially for large or complex orders. Their role is critical in offering immediacy and competitive pricing to institutions.

Revenue Model: Bid-Ask spread capture, flow internalization, staking rewards, DeFi yield (liquidity provision or lending), and inventory management gainsExecution Aggregators

e.g. DV Chain, Enigma, Wincent

Execution aggregators source quotes from multiple venues and route orders to the best available price, minimizing slippage and improving execution quality. Operating as riskless principal desks, they simplify access to fragmented markets without warehousing risk. These platforms abstract complexity for institutional clients and increasingly integrate with custody and compliance providers.

Revenue Model: Execution spreads, platform/API access fees, tiered pricing or volume-based commissions, and referral/partner fees from downstream servicesECN Platforms

e.g. Crossover, Elwood, Finery Markets, Talos

Electronic Communication Networks (ECNs) allow participants to quote and match orders in a neutral venue. They increase price transparency and enable direct access to liquidity providers without requiring bilateral relationships. ECNs enable technical API access for quote sourcing and order routing; however, participants must still onboard each liquidity provider directly to access trading and settlement services. This onboarding requirement means that while ECNs provide convenience and unified interfaces, they do not remove the operational overhead of establishing bilateral relationships. ECNs typically charge volume-based fees to liquidity providers, which can cause them to quote the market wider than they would with a direct relationship. These fees compensate for the ECN's routing infrastructure but often result in less competitive pricing than directly working with Liquidity Providers. As a result, ECNs win business more on technical simplicity, analytics, and reconciliation tooling than on pure best-price execution.

Revenue Model: Volume-based fees charged to liquidity providers, platform licensing fees, data or analytics access fees, and potential white-label or enterprise integration costs

5. Orchestration Layer - Liquidity & Settlement Coordination

Combines liquidity provision with real-time fund orchestration across multiple rails.

Orchestration-Enabled Aggregators

e.g. 1Konto, Aquanow, Zero Hash

Aggregation doesn’t end at execution. A growing class of platforms is expanding beyond quote routing into orchestration, coordinating where trades are executed and how and where they settle. These orchestration-enabled aggregators manage multi-asset, multi-rail settlement across fiat and stablecoin systems, helping trades settle directly into a client’s chosen custody provider, wallet infrastructure, or banking partner. They support diverse withdrawal instructions and custom flow paths, adapting to each institution's specific fund movement patterns and operational needs. This orchestration increases capital efficiency, accelerates settlement time, and eliminates post-trade friction, unlocking tangible improvements in operational performance and fund mobility. 1Konto exemplifies this category, integrating execution with real-time fund movement across multiple rails.

Revenue Model: Execution spreads, orchestration or routing fees, platform/API access fees, custody or settlement service fees, and volume-based pricing tier costs

6. End-User Layer – Usage & Distribution

Final delivery and utility of stablecoins across B2B and B2C use cases.

Corporate FX / PSPs

e.g. Bridge, BVNK, Conduit, Thunes

Corporate FX platforms and payment service providers (PSPs) enable cross-border payments, stablecoin treasury operations, and fiat on/off ramps for businesses. These platforms abstract regulatory complexity, providing APIs for settlement, conversion, and compliance. Their adoption is growing as corporations seek alternatives to SWIFT and correspondent banking.

Revenue Model: Spread capture, transaction fees, account or platform access fees, compliance-as-a-service revenue, and partner rev share with custody/liquidity providersEnd-User Payment Platforms

e.g. Airtm, Bitwage, Deel, Request, Remote

End-user platforms enable stablecoin payouts for payroll, remittances, or P2P payments. They often integrate APIs from orchestrators or PSPs to manage KYC, settlement, and fiat conversion. These platforms serve freelancers, underbanked users, and remote teams, unlocking new use cases for stablecoins beyond trading or speculation.

Revenue Model: Transaction fees (flat or %), FX conversion spreads, subscription or platform fees, payroll/compliance service revenue, and partner rev share from PSPs or on/off-ramp providers

How We’re Thinking About What’s Next

As the stablecoin ecosystem evolves, the most compelling opportunities are emerging where orchestration, capital efficiency, and regulatory clarity intersect. The shift from endpoint dominance to coordination-layer value capture is already reshaping how institutions route flows, manage settlement, and allocate infrastructure budgets. Understanding how value moves across layers is becoming essential for anyone building infrastructure, deploying capital, or navigating integration decisions.

This framework reflects how we see the market based on our own operating experience. We expect it to evolve as new players enter, regulation sharpens, and institutional momentum builds. If you are thinking through stablecoin infrastructure, whether as a founder, fund, or financial institution, we would welcome a conversation to compare notes or explore ways to work together.

Not Financial Advice Disclaimer