Bitcoin ETF Approval Could Unleash $100 Billion Bonanza: A New Era for Crypto Investments?

Digital Asset Market: The SEC's approval for a bitcoin ETF could bring in up to $100 billion in inflows, with analysts predicting a potential $1 billion in just the first quarter and over $50 billion inflow by the end of 2024. Standard Chartered, Galaxy, and Corestone are all expecting heavy demand for a spot bitcoin ETF, comparing it to the rise of gold ETFs and estimating that it could lead to significant price increases for bitcoin. Additionally, the SEC may also approve ether ETFs in the near future.

Macro Economics: The World Bank’s new global economic prospects report predicts that worldwide economic growth will slow in 2024 for the third year in a row, but the forecasted pullback is not enough to cause a recession. Some factors leading to the global slowdown include weak global trade and higher interest rates implemented by central banks to control inflation. Although there are still risks to growth, such as conflicts in the Middle East and rising commodity prices, the strength of the US economy has reduced the likelihood of a global recession. China’s economy is expected to slow due to tepid consumer sentiment and a downturn in the property sector, as well as an aging and shrinking population. Growth in developing economies is projected to be lower than the previous decade’s average, and overall global growth is still below the 2010s average. The outlook for the rest of the decade is not very promising, with most economies predicted to grow at a slower pace. In the long run, about one in four developing economies will be facing increased poverty levels since before the pandemic.

Equities: The S&P 500 bounced back from earlier declines on Tuesday, with tech stocks helping to regain ground lost in a tough start to 2024. The Dow Jones Industrial Average also recovered from a larger decline, while the Nasdaq Composite rose slightly. Some tech stocks, such as Nvidia and Amazon, reached new highs, and the overall shift in investor sentiment has led to increased interest in other sectors such as healthcare. The upcoming release of key inflation data later this week will provide further insight into the inflation picture and potential impact on Federal Reserve rate cuts.

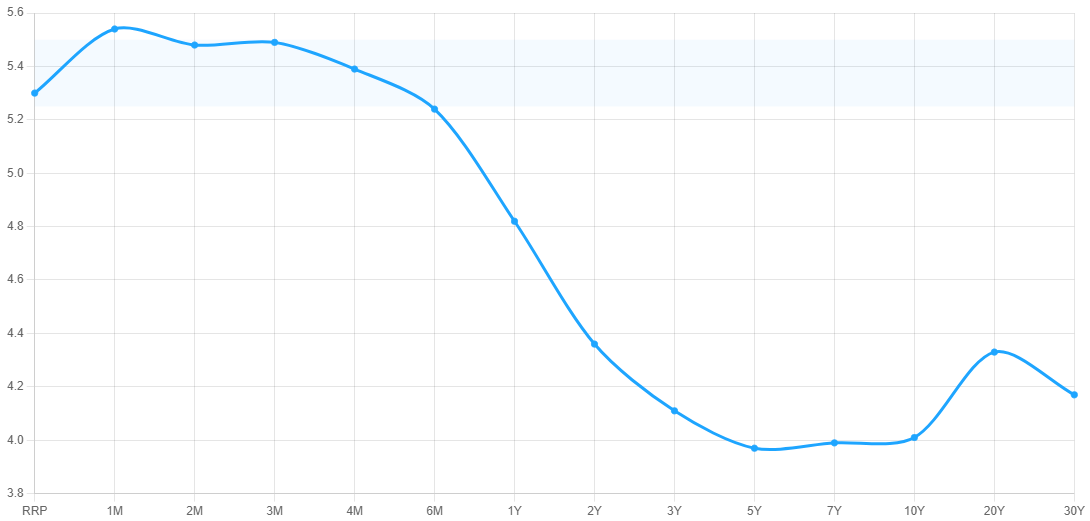

The Fed and US Treasury: Dallas Fed President Lorie Logan's comments over the weekend shed new light on how the central bank might end its ongoing effort to shrink its bond holdings through quantitative tightening (QT). The official noted that the process may be influenced by contracting liquidity in money markets and suggested slowing the pace of QT as this could lead to a more efficient balance sheet in the long run. Market participants have been closely watching the Fed's overnight reverse repo facility as an indicator of the Fed's desired liquidity levels. The Fed has thus far only provided limited guidance on how it will end QT, but with the almost certain end of rate rises and the possibility of rate cuts this year, the outlook for the balance sheet is a major focus for markets.

Geopolitical: Russia and Ukraine have been engaged in a four year war, but recently there have been signs that negotiations may be on the horizon. The US has been pushing for Ukraine to engage in peace talks, but Russia has been refusing to negotiate due to its military advantage in the conflict. The two countries have kept military losses a secret, but Ukraine's defense minister announced on Tuesday that over 200,000 troops have been killed in 2023. The war has also spread to cross-border aerial attacks, causing suffering for civilians. The US has been ramping up diplomatic efforts to persuade Moscow to negotiate, and recently held a secret meeting in Saudi Arabia with some Global South countries to rally support for Ukraine's conditions for peace talks with Russia. China, a key player in convincing Russia to compromise, did not attend the meeting. While there has been little progress made, China has expressed that Russia has shown interest in peace talks during talks with Chinese officials.

View from our desk

Bitcoin's recent surge to a one-year high of $47,000 has sparked widespread speculation about the potential new highs it could reach following the anticipated approval of a Bitcoin ETF. The consensus in the market is that an ETF approval is not just likely but inevitable, with an announcement expected later this week. While the approval is poised to trigger an initial surge in Bitcoin prices, investors should be wary of potential pullbacks. Many early investors from this year might look to capitalize on the post-approval highs by taking profits. Therefore, our advice to investors is to exercise caution and avoid getting swept up in the immediate momentum following the ETF approval.

In terms of the broader economic landscape, the year began with a minor market correction, followed by a rebound. However, we do not foresee any significant pullbacks in the near future. Our stance remains neutral regarding the economic outlook, with expectations of minor fluctuations around the current price levels. The 10-year Treasury yield, which recently rose to 4% after dipping to 3.79%, is expected to maintain this range for the foreseeable future. The Federal Reserve's need to reduce its balance sheet will likely lead to some quantitative tightening. This is expected to be balanced with reverse repo actions at the Fed window, aimed at maintaining liquidity in the market. The anticipated outcome of these measures is an improvement in the current backwardation in the market.

Investors should prepare for a period of relative stability in the markets, punctuated by small oscillations. The expected quantitative tightening by the Fed, coupled with measures to ensure liquidity, suggests a cautious approach to managing the economy. For Bitcoin and other cryptocurrencies, the potential ETF approval represents a significant milestone that could redefine market dynamics. However, the broader economic factors, including Federal Reserve policies and Treasury yields, will continue to play a crucial role in shaping the investment landscape. As always, a balanced and informed approach to investment decisions is recommended in these evolving market conditions.

Happy Trading!

The 1Konto Team

About 1Konto

1Konto excels in digital asset and FX markets, offering advanced trading technology with 24/7 access and deep liquidity. Clients benefit from precision pricing, robust platform features, and zero slippage, ensuring an efficient, secure, and high-quality trading experience.

Elevate your institution's digital asset trading with 1KPrime. Reach out today for a consultation on our tailored solutions for best price liquidity and services in digital and fx.

Not Financial Advice Disclaimer